Question

Question: On which of the below options VAT is imposed – A. Directly on consumer B. On final stage of pro...

On which of the below options VAT is imposed –

A. Directly on consumer

B. On final stage of production

C. On first stage of production

D. On all stages between production and final sale

Solution

Hint: The full form of VAT is ‘Value Added Tax’, it is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution or sale to the end consumer. It is similar to and often compared to a sales tax.

Complete step-by-step answer:

In the question it is given that we have to find where the VAT is imposed. Essentially we will study the exact meaning of what VAT is.

As we know, the full form of VAT is ‘Value Added Tax’. It is a type of tax which is levied on the price of a product at each stage of the supply chain from production to sale to the end consumer.

It is also noted that the amount of VAT that the consumer pays on the product must be less than any of the cost of material used in the product which has already been taxed. One more interesting fact about VAT is that VAT tax is based on the tax payer’s consumption rather than their income. In fact, VAT applies equally to every purchase.

The main conclusion is that VAT tax is added to a product at every stage of supply chain where value is added.

Option (D) is the correct answer because VAT is imposed on every stage between production and sale to the end consumer.

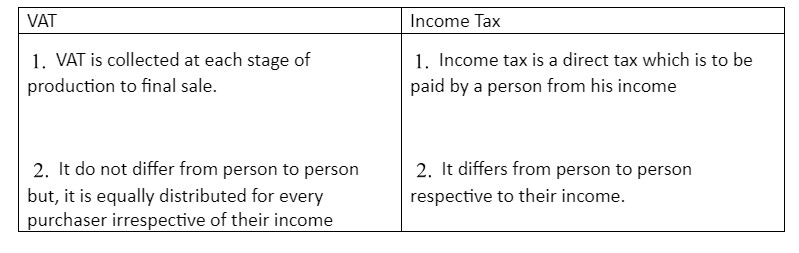

Note: Difference between income tax and Value Added Tax (VAT)